Our Impact

on Financial Stability

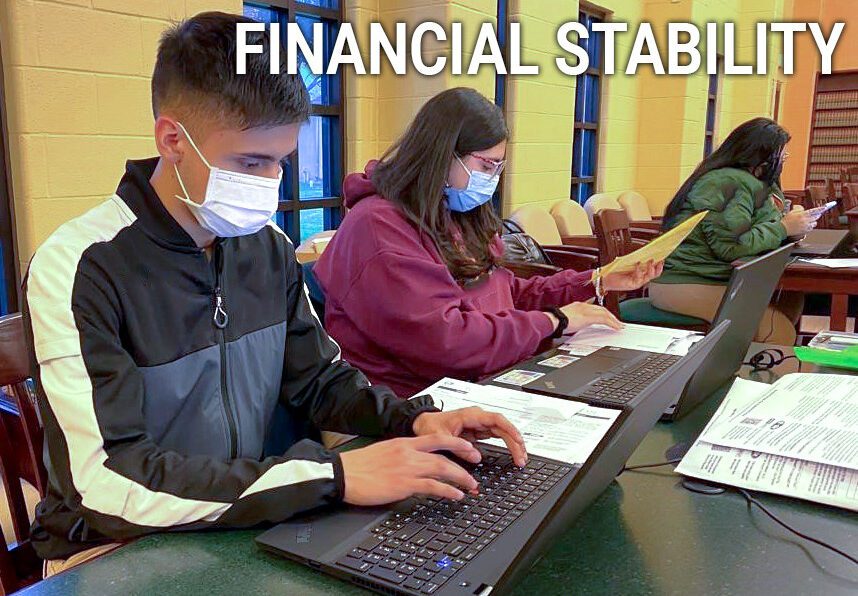

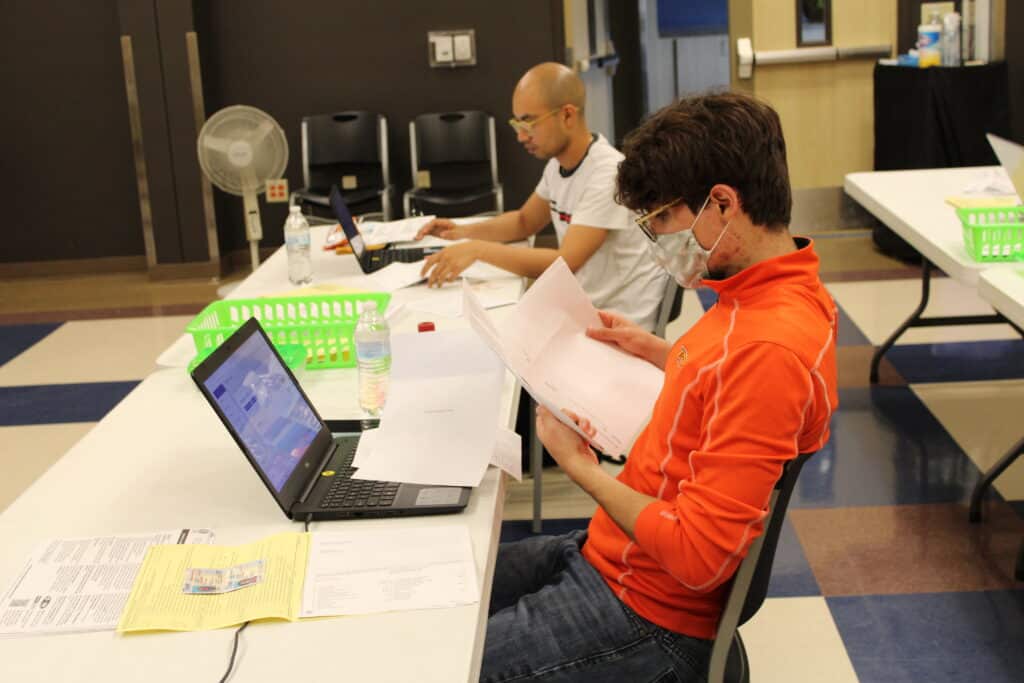

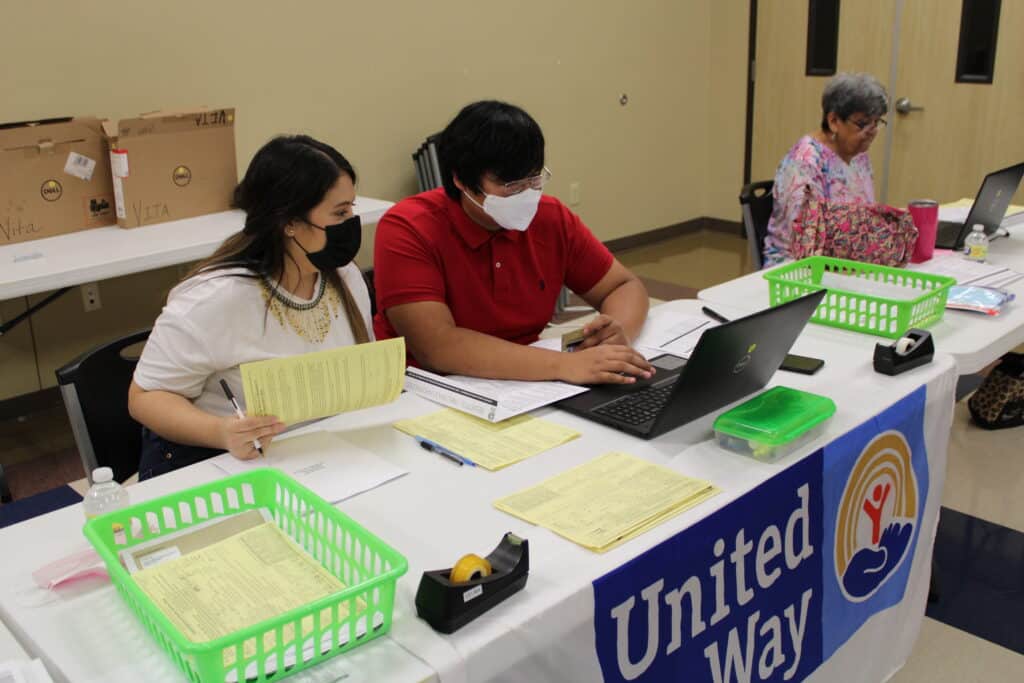

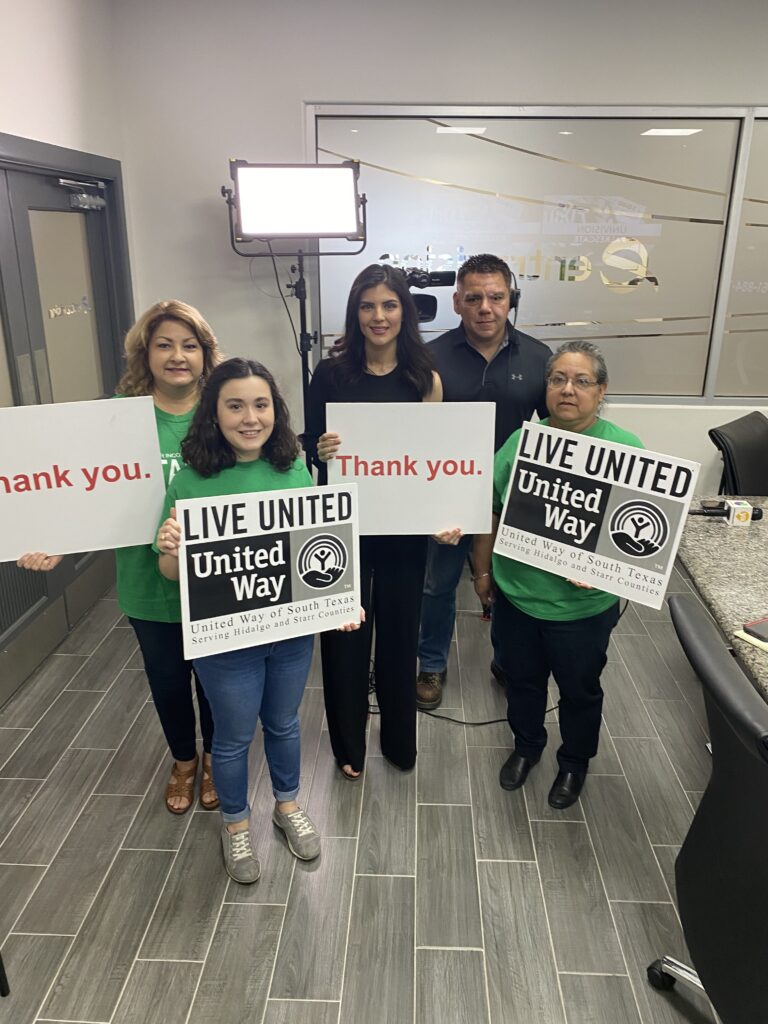

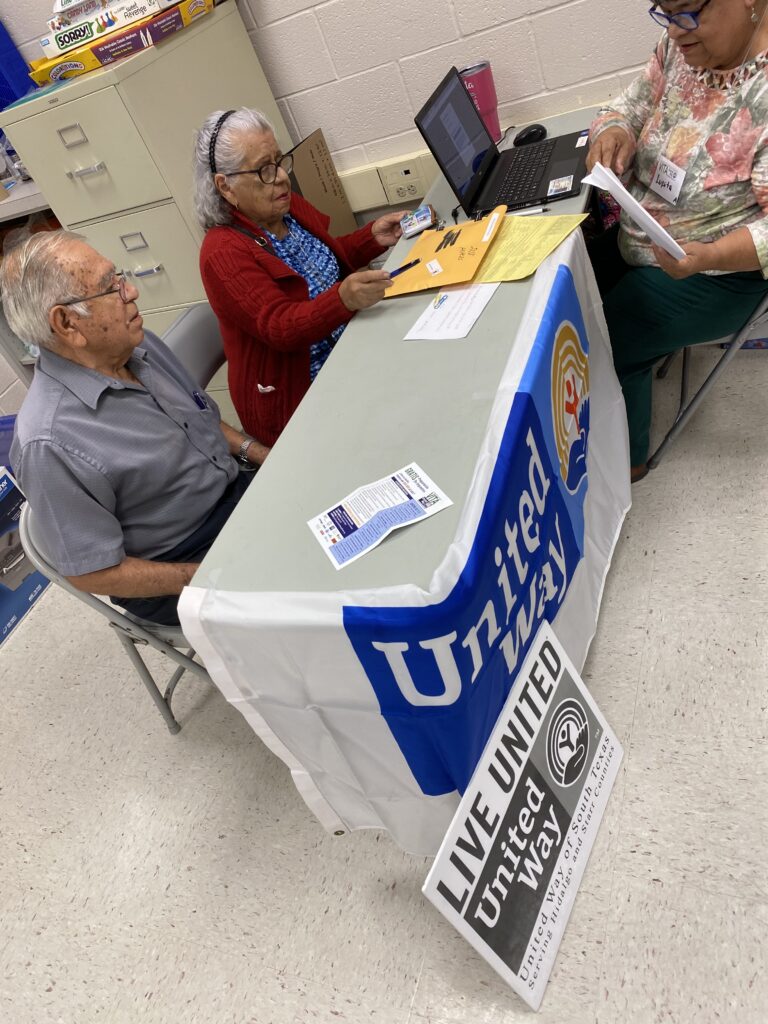

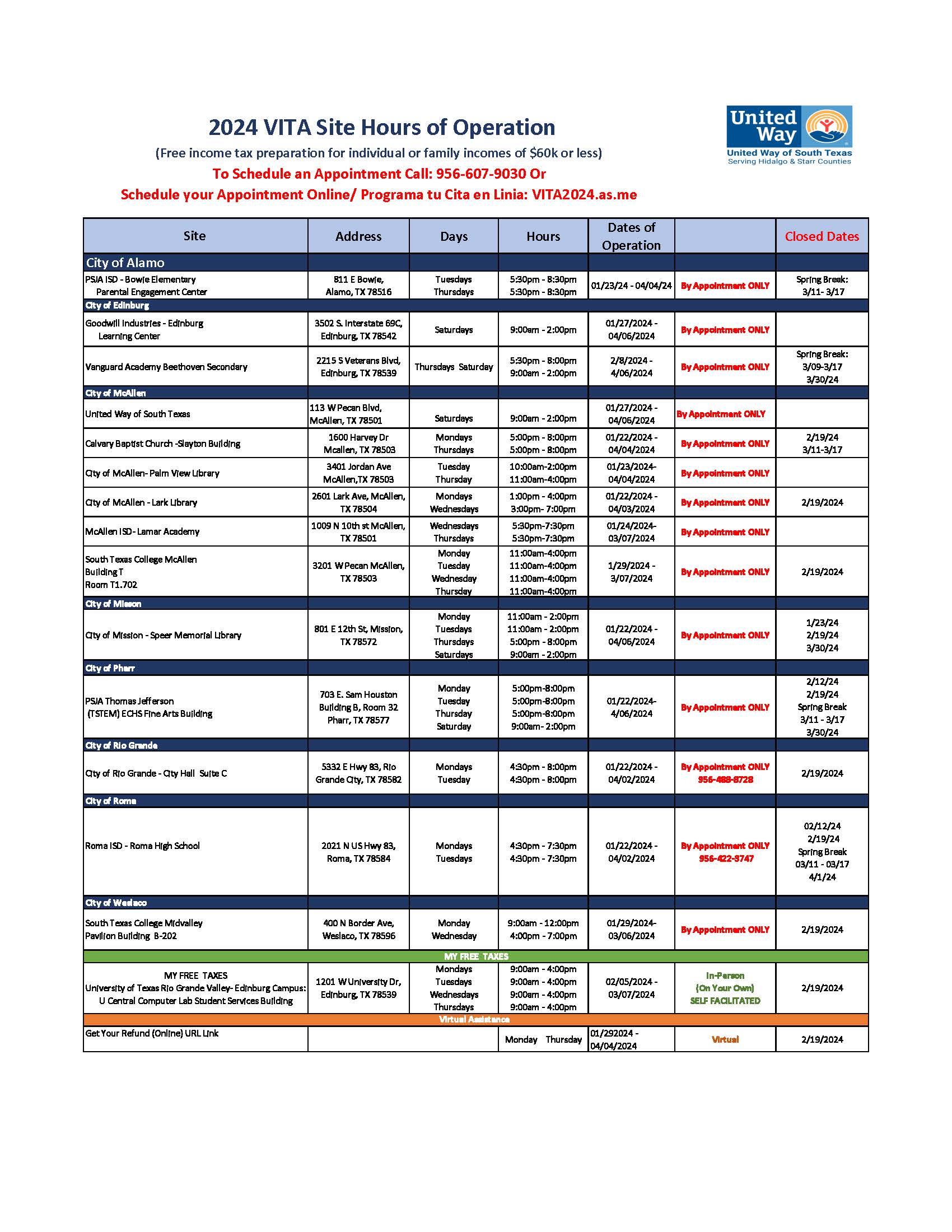

Volunteer Income Tax Assistance

The VITA program has been administered by United Way of South Texas since 2011. The program is an IRS initiative that is designed to provide free income tax preparation services to families with household incomes of less than $60,000 in Hidalgo and Starr Counties. Over 130 IRS trained and advanced certified volunteers, including high school students, college students and retired professionals, participate in the VITA program yearly. United Way tax preparation services are available to eligible clients year-round.

Call 211 for a site near you!

To volunteer and become IRS certified, contact United Way of South Texas at 956-686-6331 or southtexasvista@gmail.com.

Transportation Vouchers

United Way of South Texas distributes transportation vouchers at no cost to eligible clients through local non-profits. United Way partners with the City of McAllen – Metro McAllen, to provide transportation to clients who are eligible for the vouchers.

Some of the program partners include:

- McAllen ISD

- McAllen Housing Authority

- Tropical TX Behavioral Health

- Endeavors (Veterans)

- TX Workforce Solutions

Free vouchers are distributed thru 46 entities, such as Nuestra Clinica del Valle, Veteran’s Administration, MHMR, The Salvation Army and others.

Vouchers are used for:

- Medical Appointments

- Prescription Pick-up

- Emergency Transportation to Work

45,792 Free Bus Rides (to and from) were given, saving families approximately $57,455.

Families benefit using VITA, whether it’s in person, virtually, or on their own by accessing MyFreeTaxes.com

Is collectively saved in tax preparation fees. Families, on average, spend more than $300 on fees.

Are allotted to VITA clients year-round and during tax season